Cryptocurrencies

A cryptocurrency is a digital asset. It can be designed to function as a form of currency, a digital token or as a replacement for traditional financial assets such as precious metals. In theory there is no single body that controls the price of cryptocurrencies however, often the majority of the coins created are controlled by a few original creators. But control should be decentralized as opposed to a centralized form of control such as a government/organization. This decentralization typically worked through distributed ledger technology more commonly known as a blockchain.

The History of Cryptocurrencies

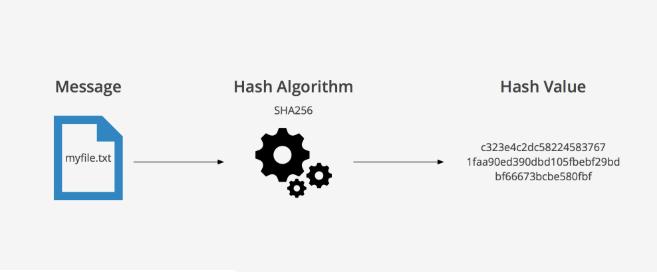

Cryptocurrencies (such as ecash, digicash and bitgold) existed before Bitcoin (BTC) however Bitcoin was the first one to gain widespread adoption. It was first released as open-source software in 2009 by someone or a group of people using the pseudonym "Satoshi Nakamoto" and is generally considered the first decentralized cryptocurrency. THe first transaction took place on 12th January 2009 and transferred 10 Bitcoins to the wallet of Hal Finney from Satoshi. Nakamoto mined about 1 million Bitcoins before disappearing from the community, it is thought he still owns the vast majority of these original 1 million coins. Bitcoin uses a SHA-256 hashing algorithim as its proof-of-work scheme.

When Bitcoin was first realeased its main users were among the cypherpunk community however after the first major price spike around $1000 a coin its use became more widespread and after the price spike up to $19,783, it has become known to a much larger and more widespread audience although there are thought to be about only 24 million owners in the world.

Ethereum

Ethereum was initially proposed in 2013 by Vitalik Buterin, a 19 year old Russian-Canadian programmer and founder of Bitcoin Magazine.

Its aim was to alow users to build other decentralized applications that don't function only as a store of value or digital currency like Bitcoin. It users a currency called Ether

Buterin, along with Gavin Wood and Joseph Lubin, released Ethereum on 30th July 2015 with 72 million coins premied, accounting for 70% of the total circulation as of December 2018. Throughout 2017 the value of Ethereum grew 13,000% to over $1400.

Cryptocurrency News Headlines

Bitcoin-Blockchain-Cryptocurrencies

Curated repository of academic literature on Bitcoin, Blockchain and Cryptocurrencies

SoK: Research Perspectives and Challenges for Bitcoin and CryptocurrenciesIntroduction

It all started with the Bitcoin Whitepaper by Satoshi Nakamoto, released in 2008. Although this whitepaper presents the core idea behind Bitcoin, it is extremely important to study the Bitcoin Source Code to appreciate the true beauty of the Bitcoin protocol. The Bitcoin and Cryptocurrency Technologies book by Narayanan et al. and the Mastering Bitcoin book by Antonopoulos are great resources to understand the intricate technical details of Bitcoin. The Coursera course on Bitcoin and Cryptocurrency Technologies goes hand-in-hand with the book by Narayanan et al., and provides an incredibly accessible explanation of Bitcoin.

Why is Bitcoin, Blockchain and Cryptocurrency technology worthy of research?

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies answers this burning question really well, and provides a comprehensive guide to interesting open problems in the area of Bitcoin, Blockchain and Cryptocurrencies. Consider this paper as an essential prerequisite to a research journey into this area.

Note: The resources curated on this page pertain to core technical material related to Bitcoin, Blockchain and Cryptocurrencies. It is strongly advised to thoroughly learn the technical fundamentals of Bitcoin before proceeding any further. The Coursera course mentioned above is a necessary and sufficient pre-requisite that suits this purpose.

Cryptography

While Bitcoin and traditional blockchain frameworks only borrow standard mechanisms of data digest (hash functions) and entity authentication (digital signatures) from cryptography, the next generation of Cryptocurrencies and Blockchain frameworks have adopted more sophisticated cryptographic tools to address the key issues of traceability and scalability. Considering this, it is important to study a few core modules of cryptography, as follows.

- Introduction to Cryptography — Chapter 1 of the Boneh-Shoup Book

- Basic notions of Encryption — Chapter 2 of the Boneh-Shoup Book

- Basic notions of Hash Function — Chapter 8 of the Boneh-Shoup Book

- Basic tools of Public Key Crypto — Chapter 10 of the Boneh-Shoup Book

- Basic notions of Signatures — Chapter 13 of the Boneh-Shoup Book

- Introduction to Elliptic Curves — Chapter 15 of the Boneh-Shoup Book

- ECDSA and Schnorr Signatures — Chapter 19 of the Boneh-Shoup Book

- Zero Knowledge Proof and SNARKs — Chapter 20 of the Boneh-Shoup Book

Note: It is not essential to rigorously study each of the references mentioned above. However, it is required to understand the core concepts behind each of the modules.

Consensus

Consensus is the essence of Bitcoin, Blockchain and Cryptocurrency technologies. While the Bitcoin Whitepaper presented the classic Nakamoto consensus in 2008, it took a number of years to formally present the analysis of the Bitcoin Backbone Protocol. This seminal work by Garay et al. (2014) has been followed up by a number of theoretical analysis of blockchain protocols in the last few years. The following technical papers are must-reads in this context.

- The Bitcoin Backbone Protocol: Analysis and Applications — Garay et al. (2014)

- Analysis of the Blockchain Protocol in Asynchronous Networks — Pass et al. (2016)

- Rethinking Large-Scale Consensus — Pass and Shi (2018)

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies

Section III offers an overview of open/solved research problems in this domain

Alternative Protocols

Building useful (and efficient) alternatives to the Bitcoin Proof-of-Work consensus protocol has also been actively explored by the research community over the last few years. In this context, the following alternative consensus protocols may be considered as must-reads.

- The scrypt Password-Based Key Derivation Function — Percival and Josefsson (2012)

- Bitcoin-NG: A Scalable Blockchain Protocol — Eyal et al. (2016)

- Simple Proofs of Sequential Work — Cohen and Pietrzak (2018)

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies

Section VI offers an overview of open/solved research problems in this domain

Decentralization

The Bitcoin Whitepaper envisaged a distributed network of peers incentivised to honestly maintain a global ledger. However, the same incentives resulted in a concentration of power in the Bitcoin mining network, and eventually, the maintenance of the ledger converged to a handful of miners and mining pools. Game Theoretic analysis of Bitcoin and Cryptocurrency incentive design is a fascinating topic. The following works are must-reads in this direction.

- Analysis of Bitcoin Pooled Mining Reward Systems — Rosenfeld (2011)

- The Miner’s Dilemma — Eyal (2014)

- On Power Splitting Games in Distributed Computation — Luu et al (2015)

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies

Section III offers an overview of open/solved research problems in this domain

Scalability

With the adoption of Cryptocurrencies and Blockchain Technology at a dizzying pace, it is of prime importance to reconsider the issues of network scalability and transaction latency. While Bitcoin supports a maximum of 7 tx/sec with a confirmation time of 10 minutes, Visa or Mastercard registers thousands of transactions per second, with lightning confirmation. Thus the most utilitarian research problem is whether decentralized blockchains can be scaled up to match the desired performance. The following are must-reads in this direction.

- On Scaling Decentralized Blockchains (position paper) — Croman et al. (2016)

- The Bitcoin Lightning Network (off-chain scalability) — Poon and Dryja (2016)

- OmniLedger (scalability through sharding) — Kokoris-Kogias et al (2017)

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies

Section VI offers an overview of open/solved research problems in this domain

Anonymity

Anonymity is a cornerstone of decentralization, and Cryptocurrencies have historically treated anonymity with utmost importance. While Bitcoin only provides pseudonymity and needs mixing networks for privacy, Monero goes one step ahead with ring signatures, and ZeroCash takes it forward with zero-knowledge proofs. Still, to date, de-anonymization and traceability are hot topics for research. The following works are must-reads in this direction.

- A Fistful of Bitcoins — Meiklejohn et al. (2013)

- An Empirical Analysis of Traceability in the Monero Blockchain — Moser et al. (2017)

- An Empirical Analysis of Anonymity in Zcash — Kappos et al. (2018)

SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies

Section VII offers an overview of open/solved research problems in this domain